On the radio, in the Wall Street Journal, CNBC, wherever I go, mysterious “speculators” get blamed for the hike in prices of commodities. Particularly oil. I had a bit of a rant about this months ago in Stop Talking About Commodities! but I think it’s getting worse… Yesterday I had a milk farmer ask me why asset managers are inflating the price of corn!

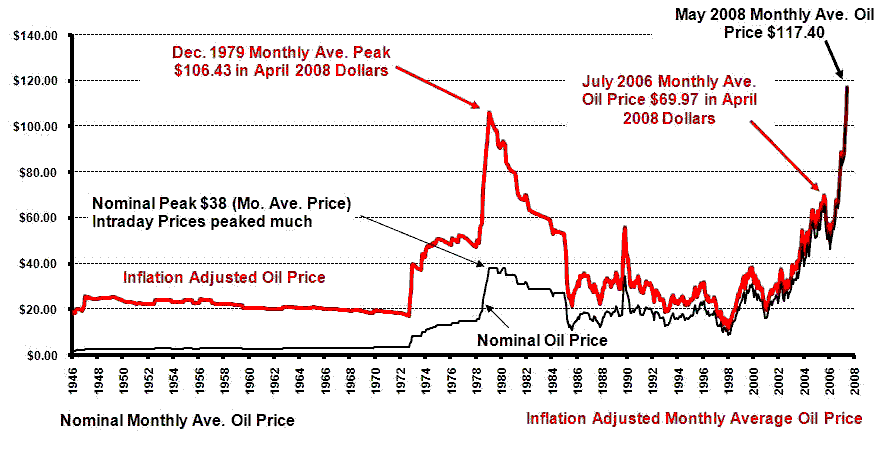

Below is an inflation-adjusted depiction of the price of oil from 1946 to (almost) the present.

A lot commentators on the subject blame (1) speculators, and (2) OPEC for the “unprecedented” price of oil. Speculators: crude oil futures were first traded in 1983 (someone correct me if I’m wrong…) yet at the end of the seventies we saw massive oil price shocks. My god, how is it possible to see price shocks like those depicted above in 1979 without infamous speculators messing with the markets through the futures exchanges?! I have an idea: the culmination of the 1970s saw the Iran-Iraq war as well as a massive depreciation of the US dollar against other major currencies. And you know what’s happening now: another Middle Eastern war and, yep, a massive depreciation of the dollar. I put the graph here into Stop Talking About Commodities! but I’m going to post it again just for kicks (the x-axis tracks from 1967 to the present). Have a guess when that first big dip in the value of the US dollar occurs. You guessed it: 1978, right when the Iran-Iraq war was underway and when the US was implementing price controls on retail gasoline. Middle Eastern war, massive depreciation of the US dollar, sound familiar? Yet in 1978 and 1979, no oil futures contracts, how could we have oil price shocks without speculators?!

A lot commentators on the subject blame (1) speculators, and (2) OPEC for the “unprecedented” price of oil. Speculators: crude oil futures were first traded in 1983 (someone correct me if I’m wrong…) yet at the end of the seventies we saw massive oil price shocks. My god, how is it possible to see price shocks like those depicted above in 1979 without infamous speculators messing with the markets through the futures exchanges?! I have an idea: the culmination of the 1970s saw the Iran-Iraq war as well as a massive depreciation of the US dollar against other major currencies. And you know what’s happening now: another Middle Eastern war and, yep, a massive depreciation of the dollar. I put the graph here into Stop Talking About Commodities! but I’m going to post it again just for kicks (the x-axis tracks from 1967 to the present). Have a guess when that first big dip in the value of the US dollar occurs. You guessed it: 1978, right when the Iran-Iraq war was underway and when the US was implementing price controls on retail gasoline. Middle Eastern war, massive depreciation of the US dollar, sound familiar? Yet in 1978 and 1979, no oil futures contracts, how could we have oil price shocks without speculators?!

Pingback: Quit Hammering the Speculators